22+ ri paycheck calculator

The state tax year is also 12 months but it differs from state to state. If youre a new employer congratulations by the way you.

Income Calculators Pay Check Salary Wage Time Sheet

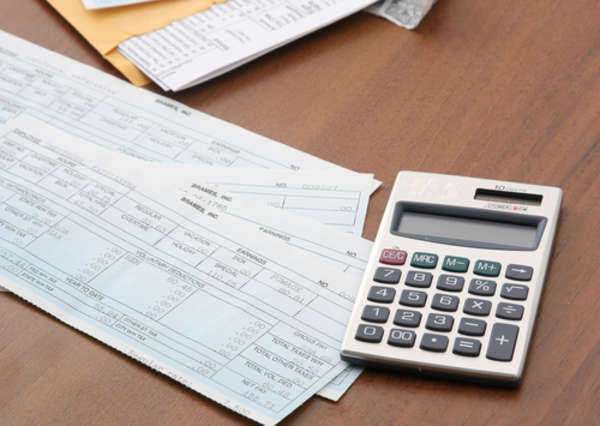

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Employers pay between 099 and 959 on the first 24600 in wages paid to each employee in a calendar year. Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. This free easy to use payroll calculator will calculate your take home pay.

Make Your Payroll Effortless and Focus on What really Matters. It is not a substitute for the. For example if an employee earns 1500.

Some states follow the federal tax. Calculating your Rhode Island state income tax is similar to the steps we listed on our Federal paycheck. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Ad Compare 5 Best Payroll Services Find the Best Rates. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only. It can also be used to help fill steps 3 and 4 of a W-4 form.

It is not a substitute for the. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This Rhode Island hourly paycheck. Your average tax rate is 1198 and your. So the tax year 2022 will start from July 01 2021 to June 30 2022.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only. Overview of Rhode Island Taxes. The tax rates vary by income level but are the same for all taxpayers.

Just enter the wages tax withholdings and other information required. Rhode Island Income Tax Calculator 2021. Rhode Island Salary Paycheck Calculator.

Rhode Island has a progressive state income tax system with three tax brackets. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Supports hourly salary income and multiple pay frequencies.

How to calculate annual income.

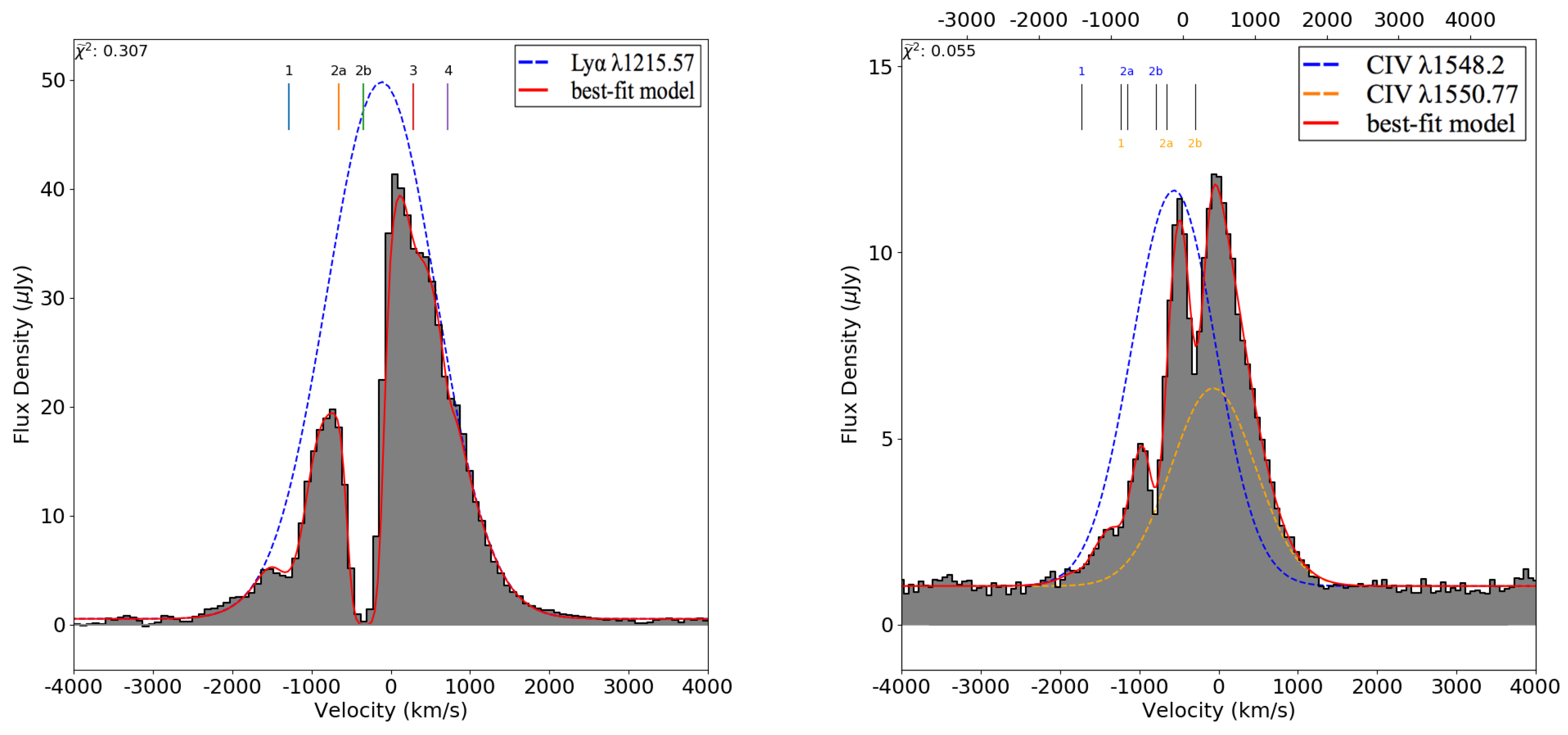

Galaxies Free Full Text Challenges And Techniques For Simulating Line Emission Html

Macroeconomic Principles Completed Study Notes Econ110 Macroeconomic Principles Mq Thinkswap

Xg0jpveu949esm

Paycheck Calculator Salaried Employees Primepay

Salary Paycheck Calculator Calculate Net Income Adp

![]()

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Paycheck Calculator Take Home Pay Calculator

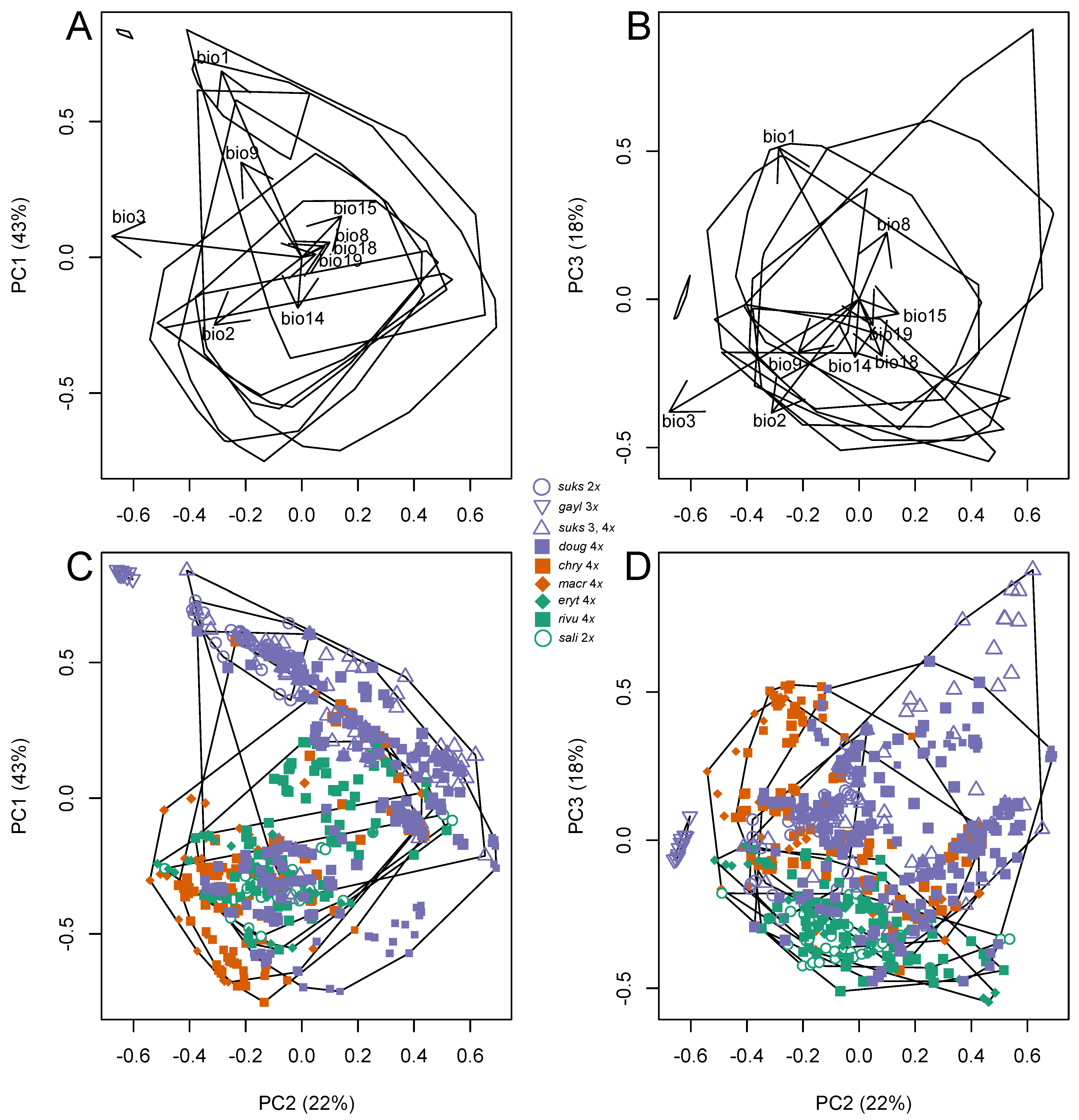

Tmgu17 Ftda 1966 0908 Xml Json At Master Kln Courses Tmgu17 Github

Paycheck Calculator And Salary Calculator Employment Laws Com

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Rhode Island Paycheck Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

N Ceunes

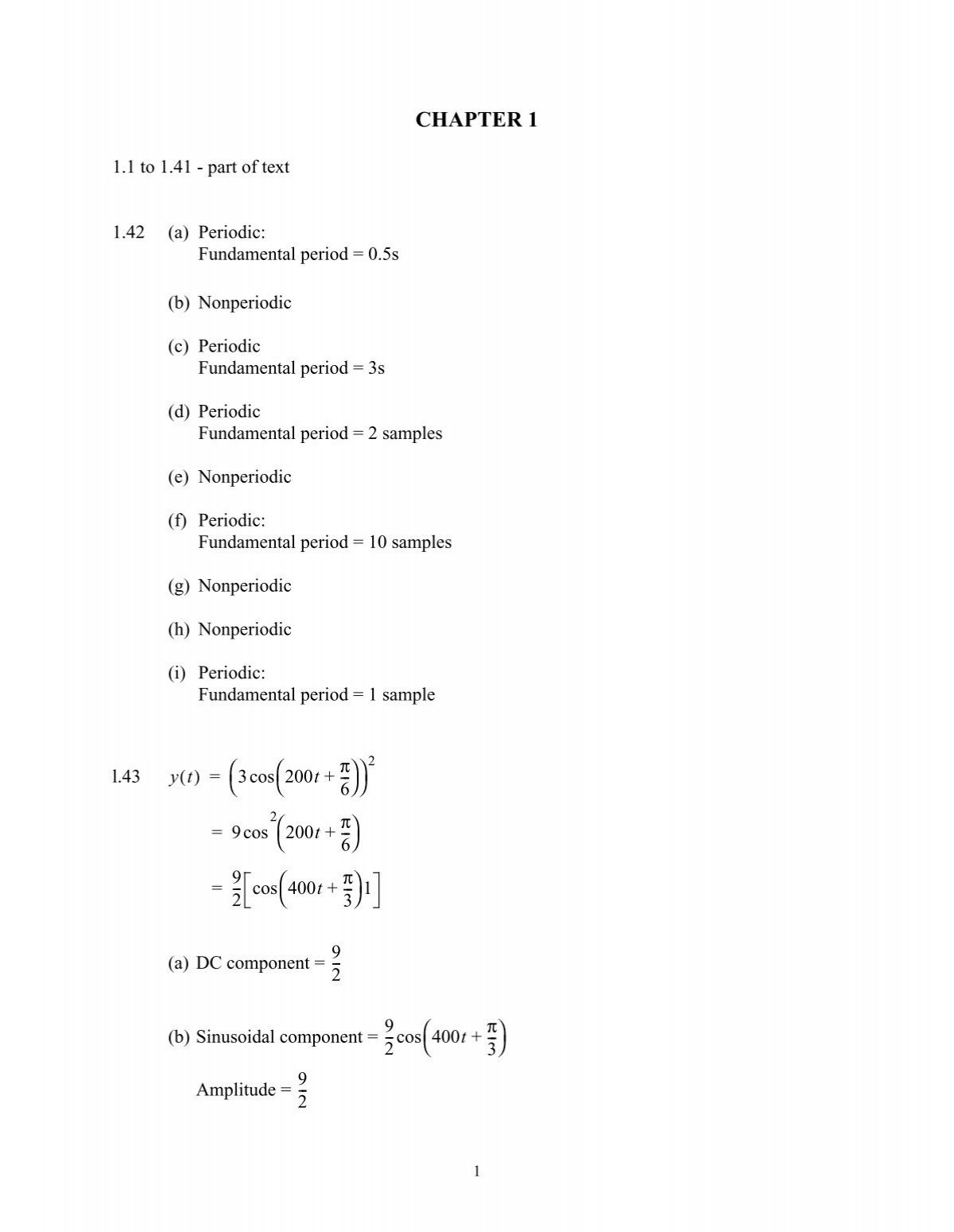

Analysis Of Financial Time Series

Premium Tax Preparation Software H R Block

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy